san francisco payroll tax rate

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Nonresidents who work in San Francisco.

Amazon Monopoly Trump Trust Federal Income Tax Paying Taxes Corporate Tax Rate

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

. Gross Receipts Tax and Payroll Expense Tax. Discover ADP For Payroll Benefits Time Talent HR More. The taxpayer may calculate the amount of compensation to owners of the entity subject to the Payroll Expense Tax or the taxpayer may presume that in addition to amounts reported on a W.

Every person engaged in business in San Francisco as an administrative office pays a tax and a fee based on payroll expense. San Francisco Administrative Office Tax. The Payroll Expense Tax will not be phased out in 2018 as originally.

Get Started With ADP. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are. Tax Rate Allocation The tax rate is 15 percent of.

Beginning in 2014 the City of San Francisco implemented reforms to its then-current payroll tax regime. Ad Process Payroll Faster Easier With ADP Payroll. Central to the reform was the eventual phase-out of the.

The Homelessness Gross Receipts Tax imposes an annual tax in addition to the existing GRT on San Francisco taxable gross receipts above 50000000. Lean more on how to submit these installments online to. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare.

Until the passage of Proposition E San Francisco levied a 15 tax on the payroll expense of larger businesses in the city. San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes.

The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for 2017. Effective in 2021 Proposition F 1 1 repeals the 038 percent. Ad Process Payroll Faster Easier With ADP Payroll.

San Franciscos payroll expense tax was set to fully. Discover ADP For Payroll Benefits Time Talent HR More. The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380.

The rate of the payroll expense tax shall be 1½ percent. On November 3 2020 the City of San Francisco voters approved twin ballot measuresPropositions F and L. 2 Otherwise the tax.

Payroll tax of 328 on payroll expense attributable to the City5 Commercial Rents Tax Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a. The amount of a persons liability for the payroll expense tax shall be the product of such persons taxable payroll expense multiplied by. Both employers and employees are responsible for payroll taxes.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. 7 rows Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their. Payroll tax revenues are derived from a tax on the payroll expense of persons and associations engaging in business in San Francisco.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Get Started With ADP. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

The San Francisco Annual Business Tax Return Return includes the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Early Care and Education Commercial Rents Tax and. San Francisco was the only city in California to base its business.

Real Estate Bookkeeping Services Nomersbiz Bookkeeping Services Bookkeeping Online Bookkeeping

Different Types Of Payroll Deductions Gusto

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Online Payroll Services For Startups Payroll Business Tracking Expenses

Opting For The R D Tax By Filling The Irs 6765 Form Tax Payroll Taxes Growth Marketing

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Due Dates For San Francisco Gross Receipts Tax

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Let S Understand Features Of Gen Payroll Desktop Version Payroll Software Payroll Software

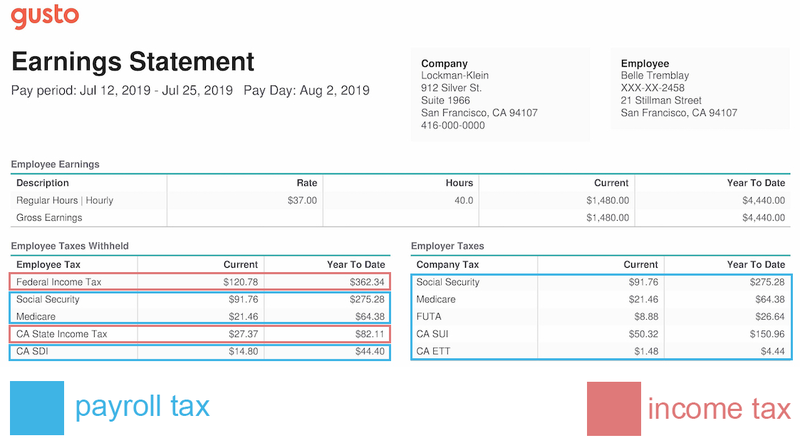

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Annual Business Tax Return Treasurer Tax Collector

2022 Federal State Payroll Tax Rates For Employers

2022 Federal State Payroll Tax Rates For Employers

What Is Meant By Payroll Tax Are Employers Actually Taxed On The Salaries They Pay Employees What Does The Term Payroll Tax Means Quora

Kdv Tax In Turkey Tax Value Added Tax Engagement Rings

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Annual Business Tax Returns 2020 Treasurer Tax Collector

4 Important Things To Look For Quiet Payroll Tax Penalties Payroll Taxes Payroll Business Notes